UAE Corporate Tax: A New Era for Mainland-UAE and Free Zone Companies

As of 1 June 2023, a 9% corporate tax is to be applied to UAE businesses on profits above AED 375,000. Free Zone companies are exempt from this provided they meet certain conditions. However, much lies in the fine print of these conditions themselves.

Free Zone companies must be aware that corporate tax could not only apply but also that the scope of coverage and effective tax rate may exceed 9% due to various factors that include domestic conditions on supplies as well as cross border taxation, transfer pricing and other OECD guidelines.

Corporate Taxation of Free Zones in the UAE

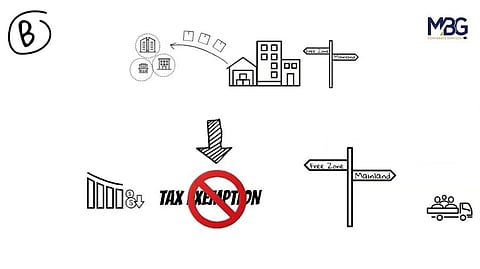

The UAE’s numerous Free Zone companies have been a key driver of its international trade. Free Zones enjoy various exemptions including 100% foreign ownership, 100% customs and VAT exemptions, 100% repatriation of capital and profits, corporate tax exemptions, etc.

The new corporate taxation enables the UAE Government to fulfill its agenda of economic reforms with growth as tax exemptions to such Free Zones act as a multiplier - provided certain conditions are met.

Free Zone entities enjoy tax holidays provided they maintain adequate economic substance, comply with regulatory requirements of the respective free zone, ensure audited books of account and, most importantly, do not earn income from Mainland entities or derive service income within the Free Zone or from other Free Zones.

UAE's Non-Oil Foreign Trade Exceeds $280 Billion in H1 2022

The exposure of Permanent Establishment for Free Zones on doing business through mainland entities and 0% withholding on payment made by mainland entities to Free Zones is another concept that is introduced here in this part of the world and would have a far reaching impact going forward.

Free Zone Regulations and Interplay with Economic Substance Regulations (ESR)

Free Zone conditions for tax exemption may conflict with other provisions of the existing laws such as the impact on extant Economic Substance Regulations (ESR). It’s unclear whether there will be any change in the UAE ESR following the introduction of corporate taxes.

The intent behind introducing the ESR was to prevent multinational groups from artificially shifting profits to jurisdictions that impose little or no income tax without substantial economic activity in that jurisdiction.

In other words, to bring in global standards developed by the OECD and the EU for business taxation to prevent harmful tax practices while doing business in the UAE.

In light of this, it is possible that the ESR will continue to apply to UAE entities and branches that benefit from Free Zone incentives.

It is likely that the ESR will phase out for entities that are subject to 9% corporate tax.

Similarly, there may be attempts to restructure Free Zone operations in terms of revenue streams, employee visas, and use of assets to protect Free Zones from being taxed as a Mainland company.

The timing and manner of such restructuring along with a reading of the anti-abuse provisions in the proposed tax law will determine the possibilities and the impact on corporate taxes and other compliances.

Another important aspect is when a Free Zone entity does not wish to enjoy corporate tax exemption, it can make an irrevocable election to be subject to the regular corporate taxation and also become a part of a tax group to enjoy easier administration of tax compliances and benefit from setting off of group-company losses.

This way, it can continue its business without any impact whatsoever.

Read More: H.E. Mariam bint Mohammed Almheiri: Role of Women Key to UAE's Success